Analyzing Market Share and Total Value of EU Wine Imports (2018-2022)

Discover the evolving market shares and the total value of wine and must imports (>10L) into the European Union from 2018 to 2022 as we analyze the dynamic landscape of the EU wine industry.

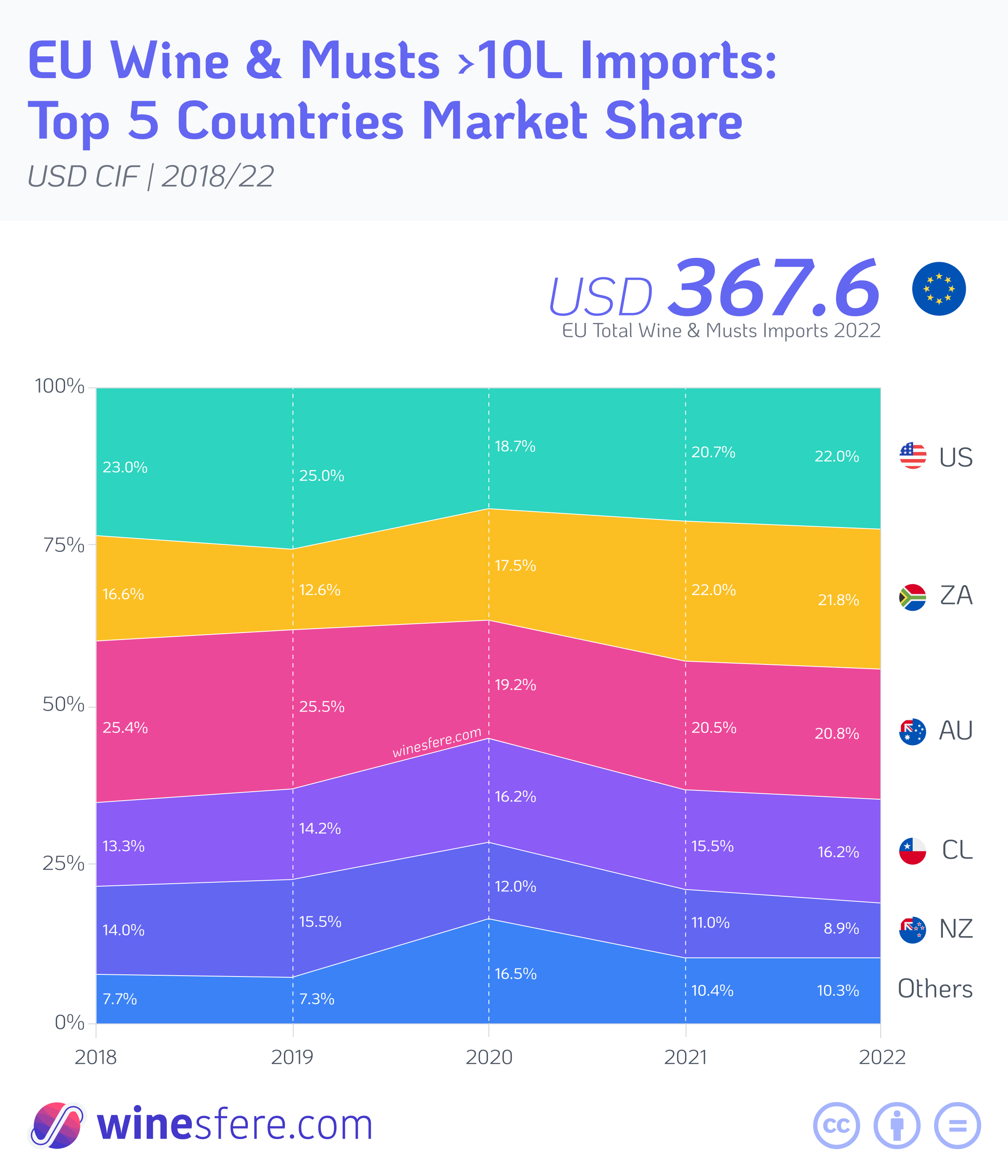

Welcome to another insightful blog post from Winesfere, your trusted source of wine industry analysis. Today, we dive deep into the evolving market shares of wine and must imports (>10L) into the European Union between 2018 and 2022. Furthermore, we will explore the total value of imports in USD CIF each year, shedding light on the overall market trends. The dynamic landscape of wine imports in the EU reveals interesting trends that wine enthusiasts and industry professionals should not miss.

Declining Total Import Value:

From 2018 to 2022, the total value of wine and musts imports to the EU experienced a notable decline. The import value dropped from 1,053.78 million USD in 2018 to 367.62 million USD in 2022. This decrease could be attributed to shifts in consumer preferences, economic fluctuations, trade policies, and potential disruptions in trade and distribution networks.

The Resilient Performance of South Africa:

While the total value of wines and musts (>10L) imports to the EU declined from 2018 to 2022, South Africa's wine exports in this segment demonstrated resilience, with its market share increasing from 16.63% in 2018 to 21.81% in 2022. This relatively strong performance can be attributed to the increasing global appreciation for South African wines and successful marketing and trade initiatives, which allowed the country to capture a larger market share despite the overall decrease in import value.

The Endurance of Australia and the USA:

Despite facing a decline in market share between 2019 and 2020 in the wines and musts (>10L) segment, Australia and the USA managed to bounce back in the following years. By 2022, Australia's market share reached 20.80%, while the USA's climbed to 21.96%. This steadfastness demonstrates these two wine-producing giants' strong appeal and adaptability in this market segment.

New Zealand's Declining Market Share:

In contrast to the success of other major wine exporters in the wines and musts (>10L) segment, New Zealand experienced a downward trend in market share, dropping from 14.00% in 2018 to 8.91% in 2022. Factors such as increased competition, shifting consumer preferences, and possible challenges in distribution networks could have contributed to this decline.

Chile's Steady Growth:

Chile, another prominent player in the wine export industry, exhibited steady growth in the market share of wines and musts (>10L) over the years, increasing from 13.27% in 2018 to 16.22% in 2022. This growth can be attributed to Chile's consistent production of high-quality wines at competitive prices, successful marketing efforts, and the expansion of trade relations with the European Union. Chilean wines in this segment have become increasingly popular among European consumers, solidifying the country's position as a critical player in the EU wine import market.

The Fluctuating "Others" Category:

The "Others" category, which includes all other wine-exporting countries in the wines and musts (>10L) segment, saw a significant surge in market share in 2020 (16.47%), only to fall back to 10.29% by 2022. This suggests that the EU wine import market in this segment remains competitive, with emerging wine regions striving to make their mark on the global stage.

EU Wine Imports: Challenges & Adaptation

The EU wine import landscape experienced notable shifts in market share from 2018 to 2022. Despite a decline in total import value, which indicates industry challenges, the rising market share of South Africa, the endurance of Australia and the USA, and the steady growth of Chile demonstrate the adaptability of crucial producers in a competitive market. Meanwhile, New Zealand's market share decline and fluctuations in the "Others" category suggest ongoing market dynamics, product positioning strategies, and possible changes in consumer behavior.

Keep checking back for more insightful articles and in-depth analyses from Winesfere. Remember to follow us on Twitter and LinkedIn to stay up-to-date on the latest wine trends, market movements, and trade developments. Here's to staying knowledgeable and flourishing in the wine world! 🍷🌐