Germany's Wine Imports: Analyzing Divergence and Similarities from 2019 to 2022

As ProWein 2023 approaches, we analyze Germany's wine import trends from 2019 to 2022. Discover key insights on market dynamics, the evolving popularity of wine categories, and the growth of Bordeaux and Toscana appellations in the German market.

As we look forward to ProWein 2023, one of the wine industry's largest annual fairs held in Düsseldorf, Germany, it's essential to analyze the trends and changes in Germany's wine imports over the past few years. Winesfere has gathered data on the import values of various wine categories from 2019 to 2022, revealing exciting patterns and significant fluctuations in the market.

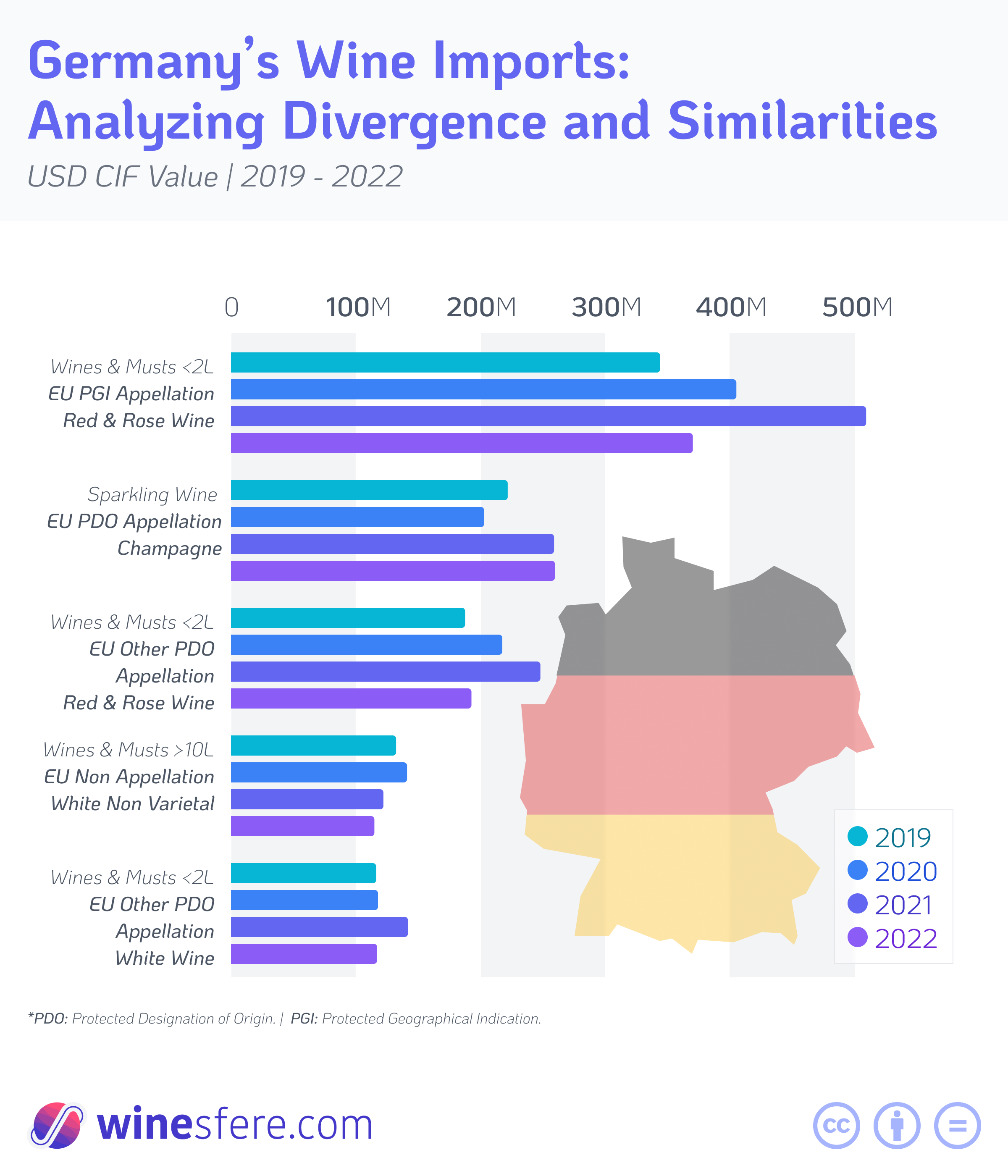

From 2019 to 2021, we saw a remarkable increase in the import value of Wines & Musts <2L from EU PGI Appellation Red & Rose Wine, surging from $344.8 million to $509.3 million. However, 2022 declined to $370.9 million, indicating a potential pandemic effect or market factors. This category remains the leader in Germany's wine imports, showing a strong affinity for these wines among German consumers.

Another exciting trend is the resurgence of the Sparkling Wine segment. EU PDO Appellation Champagne imports had a minor dip between 2019 and 2020, going from $221.6 million to $203.0 million, but recovered remarkably in the following years, reaching $260.0 million in 2022. This impressive growth showcases the renewed popularity of this classic bubbly in the German market.

One noteworthy trend involves the performance of two well-known appellations, Bordeaux and Toscana, in the German market. The import value of Wines & Musts <2L PDO Appellation Bordeaux Red & Rose Wine experienced a significant rise from 2019's $119.4 million to 2021's $142.0 million. However, 2022 saw a decline to $107.4 million. Despite the decrease, the continued popularity of Bordeaux wines in Germany reflects the region's historical reputation and the enduring appeal of its varietals.

Meanwhile, the Wines & Musts <2L PDO Appellation Toscana Red & Rose Wine category experienced relatively steady growth from 2019 to 2021, with import values increasing from $74.4 million to $100.6 million. The year 2022 slightly declined to $80.4 million, but the overall trend suggests a continued interest in Toscana wines among German consumers.

In contrast to these established regions, the Wines & Musts >10L EU Other Varietal Non-Appellation Red & Rose Wine category saw a decline in import values from a peak of $85.9 million in 2020 to $64.9 million in 2022. This trend could suggest that German consumers are gravitating toward wines with more specific geographical indications, favoring the distinctive characteristics associated with particular appellations.

In conclusion, the German wine import market from 2019 to 2022 has shown fluctuations across different categories. While specific segments like EU PGI Appellation Red & Rose Wine and EU PDO Appellation Champagne remained popular, others like Bordeaux and Toscana also experienced fluctuations, indicating an evolving and dynamic market. These insights will provide valuable context for attendees of the upcoming ProWein fair as they navigate the complex and ever-changing world of wine.

Discover the Future of Wine Intelligence with Winesfere's Revolutionary BI Platform! Simplify monitoring and decoding the ever-changing global wine trade landscape for your entire team. Stay ahead in this era of economic unpredictability and supply chain disruptions by uncovering hidden market opportunities and mitigating threats before your competitors. Get ready to elevate your wine business - Launching Soon!