Navigating Spain's Evolving Bulk Wine Exports (>10L): Market Shares and Trends (2018-2022)

Explore the dynamics of Spain's bulk wine exports from 2018 to 2022 with Winesfere, the leading BI platform for the global wine trade. Delve into key market shares, trends, and insights to navigate this ever-evolving landscape successfully.

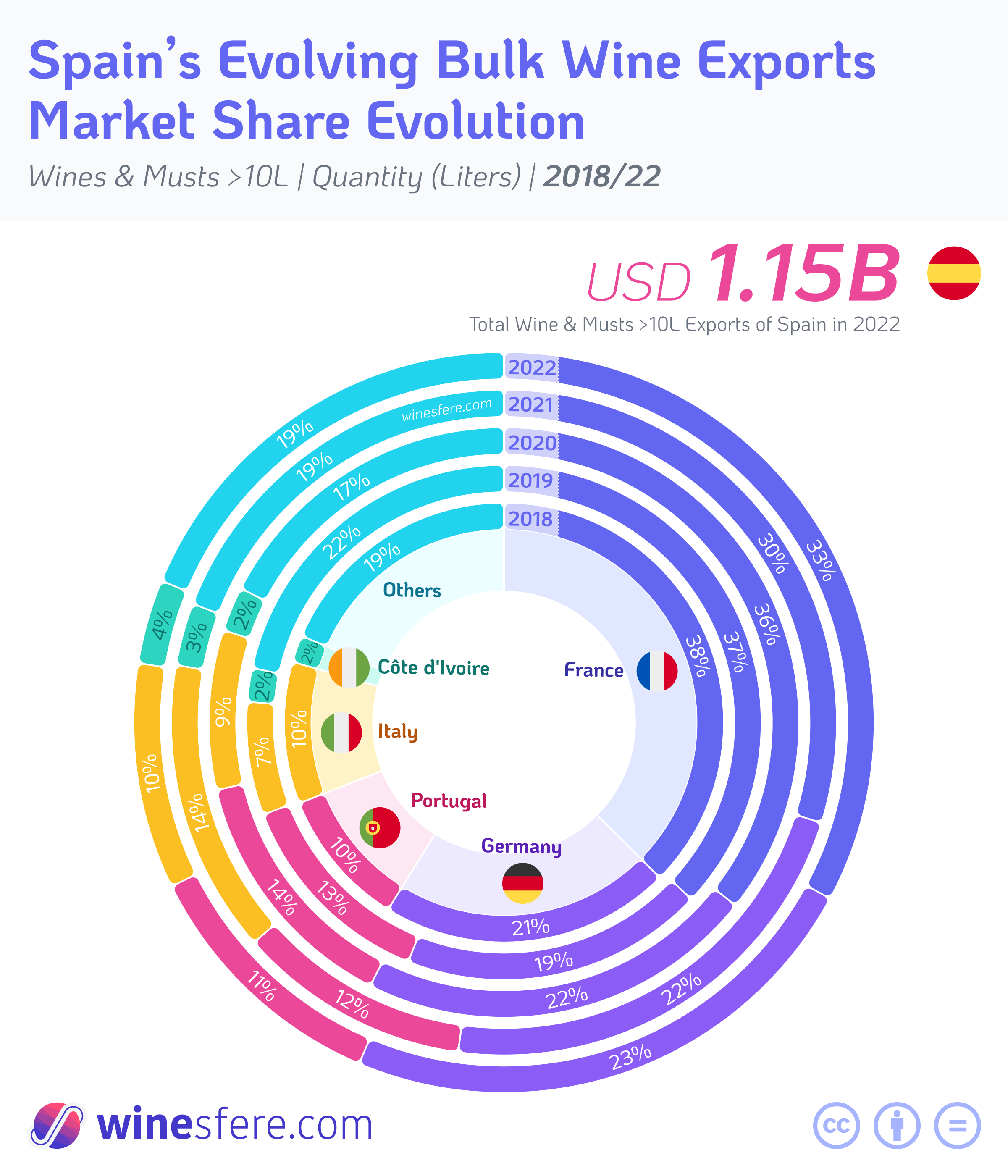

At Winesfere, we're dedicated to guiding our clients through the complexities of the global wine trade. This blog post comprehensively reviews Spain's bulk wine exports (>10L) from 2018 to 2022. As the world's top exporter of bulk wine, Spain's export landscape offers valuable insights into the dynamics of the global wine market.

A Broad Overview

Between 2018 and 2022, Spain's bulk wine export landscape was characterized by consistency and change. France remained Spain's largest import partner throughout the period, while Germany showcased a robust upward trend in its wine imports from Spain. Portugal, Italy, Côte d'Ivoire, and various other countries also play significant roles in the Spanish wine export narrative.

France: A Constant Companion

France has consistently been the largest importer of Spanish bulk wines. While there have been slight year-to-year variations, the relationship between Spain and France within the wine trade has remained strong and steady, reflecting France's enduring demand for Spanish wines.

Germany: Developing Taste

Germany's increasing imports of Spanish bulk wines from 223 million liters in 2018 to 270 million liters in 2022 demonstrate the growing popularity and appreciation of Spanish wines within the German market.

Portugal and Italy: Markets in Flux

Portugal's imports of bulk Spanish wines increased significantly in 2019, indicating a growing interest in Spanish wines. On the other hand, Italy experienced a surge in its imports of bulk Spanish wines in 2021, nearly doubling the figures from 2020 before experiencing a drop in 2022. This volatility reflects the dynamic nature of wine trade relations, shaped by trade policies, market preferences, and economic conditions.

Côte d'Ivoire: An Emerging Player

Côte d'Ivoire, though a smaller market than its European counterparts, has demonstrated a consistent uptick in its imports of Spanish bulk wines. This steady increase suggests a growing demand for Spanish wines in Côte d'Ivoire, highlighting the importance of identifying and understanding emerging markets.

Others: The Power of Diversity

The 'Other Countries' category is increasing, indicating that bulk Spanish wines are finding their place in various global markets. This diversification can be a solid strategy for mitigating risks associated with reliance on a few key markets.

Spain's Market Presence: Strong and Steady

Despite the shifting dynamics of the global wine industry and various geopolitical events, Spain has maintained a strong presence in the bulk wine market. The total exports of Spanish bulk wines have slightly increased over the years, reaching a peak in 2021.

A Dynamic Landscape

The global wine market is a complex, ever-evolving landscape, and understanding its trends is crucial for businesses aiming to stay competitive. Winesfere, the leading BI platform for the global wine trade, is committed to providing data-driven insights to help our clients navigate this dynamic field. Stay tuned to our blog for more in-depth analyses and updates on the global wine trade.

As the leading BI platform for the global wine trade, Winesfere is dedicated to providing you with the latest insights and data-driven solutions. Stay tuned for more updates and analyses in our next posts.